Navigating Dade County Lien Searches: A Comprehensive Guide

Conducting a Dade County lien search is a crucial step in various real estate and financial transactions. Whether you’re a prospective homebuyer, a real estate investor, or a lender, understanding the process of uncovering potential liens on a property within Dade County, Florida, is essential. This guide provides a comprehensive overview of how to perform a Dade County lien search, the types of liens you might encounter, and why this due diligence is so vital.

Understanding Liens in Dade County

A lien is a legal claim or right against a property, serving as security for a debt or obligation. In Dade County, liens can arise from various sources, including unpaid taxes, contractor services, judgments, and more. These claims can significantly impact the transfer of property ownership and the overall financial health of the asset. A thorough Dade County lien search is therefore indispensable to avoid potential legal and financial complications.

Types of Liens You Might Encounter

- Tax Liens: These liens are imposed by the government (federal, state, or local) for unpaid taxes. They often take priority over other types of liens.

- Mechanic’s Liens: Filed by contractors, subcontractors, or suppliers who have provided labor or materials to improve a property but haven’t been paid.

- Judgment Liens: Result from a court judgment against a property owner.

- Mortgage Liens: Created when a property owner takes out a mortgage loan to purchase or refinance a property.

- HOA Liens: Homeowners Association (HOA) liens arise when homeowners fail to pay their HOA dues.

- Code Enforcement Liens: Issued by local authorities for violations of building codes or other municipal regulations.

Why Conduct a Dade County Lien Search?

Performing a Dade County lien search offers several key benefits:

- Risk Mitigation: Identifying existing liens allows you to assess the financial risks associated with a property before making a purchase or investment.

- Clear Title: A lien search helps ensure that the property has a clear title, which is essential for a smooth transfer of ownership.

- Negotiating Power: Discovering liens can provide leverage in negotiations with the seller. You might be able to request that they clear the liens before closing the deal.

- Avoiding Surprises: Uncovering liens prevents unexpected financial burdens after you acquire the property.

- Legal Compliance: In some cases, conducting a lien search is required by law or by lenders as part of the due diligence process.

How to Perform a Dade County Lien Search

There are several methods for conducting a Dade County lien search:

Online Resources

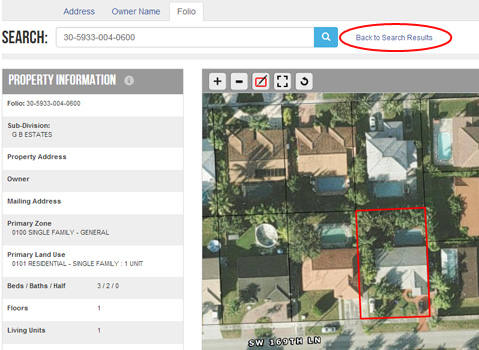

Miami-Dade County offers online resources that allow you to search for official records, including liens. The Miami-Dade County Clerk’s website is a good starting point. You can typically search by property address, owner’s name, or other relevant criteria. [See also: Miami-Dade County Official Records Search]

Utilizing the online portal often involves navigating through various databases and search tools. It’s essential to understand the specific search parameters and how to interpret the results. While convenient, online searches may not always provide a complete picture, as some older records might not be digitized.

Visiting the County Clerk’s Office

Another option is to visit the Miami-Dade County Clerk’s office in person. Here, you can access physical records and receive assistance from county staff. This method can be particularly useful for complex searches or when you need to examine original documents. [See also: Contact Information for Miami-Dade County Clerk]

Going to the County Clerk’s office allows for a more thorough investigation, especially when dealing with older or less accessible records. However, it can be time-consuming and may require a trip to the physical location.

Hiring a Title Company or Attorney

For the most comprehensive and reliable Dade County lien search, consider hiring a title company or real estate attorney. These professionals have the expertise and resources to conduct thorough searches and provide legal guidance. They can identify potential issues and help you navigate the complexities of real estate transactions. [See also: Benefits of Hiring a Title Company]

Title companies and attorneys offer the advantage of experience and specialized knowledge. They can interpret complex legal documents and provide assurance that the title is clear and marketable. While this option involves a fee, it can save you time and reduce the risk of costly mistakes.

Steps in Conducting a Lien Search

- Gather Information: Collect all relevant information about the property, including the address, owner’s name, and legal description.

- Search Official Records: Use online resources, visit the County Clerk’s office, or hire a professional to search for recorded liens.

- Review Search Results: Carefully examine the search results to identify any potential liens. Pay attention to the type of lien, the amount owed, and the lienholder.

- Verify Lien Validity: If you find a lien, verify its validity by checking the supporting documentation and ensuring that it was properly recorded.

- Address Any Liens: If you discover valid liens, work with the seller or your attorney to resolve them before closing the transaction. This might involve paying off the debt, negotiating a settlement, or obtaining a release of lien.

Common Mistakes to Avoid During a Dade County Lien Search

Even with the best intentions, mistakes can happen during a Dade County lien search. Here are some common pitfalls to avoid:

- Relying Solely on Online Searches: While online searches are convenient, they may not be comprehensive. Always cross-reference online results with other sources.

- Misinterpreting Legal Documents: Legal documents can be complex and confusing. If you’re not familiar with legal terminology, seek professional assistance.

- Ignoring Small Liens: Even small liens can cause problems down the road. Don’t overlook any potential claims against the property.

- Failing to Verify Lien Validity: Always verify the validity of any liens you find. A lien might be invalid if it was improperly recorded or if the debt has already been paid.

- Not Addressing Liens Before Closing: Make sure that all liens are resolved before you close the transaction. Otherwise, you could be responsible for paying off the debts.

The Importance of Professional Assistance

While it’s possible to conduct a Dade County lien search on your own, hiring a professional title company or real estate attorney is highly recommended. These professionals have the expertise and resources to ensure that the search is thorough and accurate. They can also provide valuable legal guidance and help you navigate the complexities of real estate transactions. A professional Dade County lien search can save you time, reduce risk, and provide peace of mind.

In conclusion, a Dade County lien search is a critical step in any real estate transaction. By understanding the process, the types of liens you might encounter, and the importance of professional assistance, you can protect your interests and ensure a smooth and successful transaction. Whether you choose to conduct the search yourself or hire a professional, make sure to approach the process with diligence and attention to detail. This proactive approach will help you avoid potential legal and financial complications and ensure that you’re making a sound investment.