Is Mutual of Omaha Dental Insurance Right for You? A Comprehensive Review

Choosing the right dental insurance can feel overwhelming. With numerous providers and plans available, it’s crucial to find one that fits your individual needs and budget. Mutual of Omaha dental insurance is a well-known option, but is it the right choice for you? This comprehensive review will delve into the details of their plans, coverage options, costs, and customer satisfaction to help you make an informed decision.

Mutual of Omaha has been a trusted name in the insurance industry for over a century, providing various financial products, including life, disability, and dental insurance. Their dental insurance plans are designed to help individuals and families maintain oral health while managing dental care costs. Let’s explore what Mutual of Omaha dental insurance offers and how it compares to other providers.

Understanding Mutual of Omaha Dental Insurance Plans

Mutual of Omaha offers a range of dental insurance plans to cater to different needs and budgets. These plans typically fall into two main categories: Dental PPO (Preferred Provider Organization) and Dental HMO (Health Maintenance Organization), although the specific offerings can vary by location. Understanding the differences between these plan types is essential for selecting the right option for you.

Dental PPO Plans

Dental PPO plans offer greater flexibility in choosing your dentist. You can visit any licensed dentist, but you’ll typically pay less when you see a dentist within the Mutual of Omaha network. These plans usually have a deductible, coinsurance, and an annual maximum benefit. Mutual of Omaha dental insurance PPO plans often cover a percentage of the cost for preventive care (such as cleanings and exams), basic procedures (like fillings), and major procedures (such as crowns and dentures).

- Flexibility: Choose any dentist you like.

- In-network savings: Lower costs when visiting in-network dentists.

- Coverage: Typically covers preventive, basic, and major procedures.

- Deductible: An amount you pay before coverage kicks in.

- Coinsurance: A percentage of the cost you share with the insurance company.

- Annual Maximum: The maximum amount the plan will pay for dental care in a year.

Dental HMO Plans

Dental HMO plans typically require you to choose a primary care dentist (PCD) within the Mutual of Omaha network. You’ll need a referral from your PCD to see a specialist. HMO plans often have lower premiums and may not have a deductible, but your choice of dentists is limited. These plans often cover preventive care and may have copays for other services. While less common, Mutual of Omaha dental insurance may offer HMO plans in certain areas.

- Lower Premiums: Typically less expensive than PPO plans.

- Network Restrictions: Must choose a primary care dentist within the network.

- Referrals: May need a referral to see a specialist.

- Copays: Fixed amounts you pay for certain services.

Coverage Details and Benefits of Mutual of Omaha Dental Insurance

The specific coverage details of Mutual of Omaha dental insurance plans can vary depending on the plan you choose. However, most plans typically include coverage for the following:

- Preventive Care: This includes routine cleanings, exams, and X-rays. Most plans cover 100% of preventive care when you see an in-network dentist.

- Basic Procedures: This includes fillings, simple extractions, and root canals. Coverage for basic procedures is usually around 80% after you meet your deductible.

- Major Procedures: This includes crowns, bridges, dentures, and implants. Coverage for major procedures is typically around 50% after you meet your deductible.

It’s important to carefully review the plan’s Summary of Benefits and Coverage (SBC) to understand the specific coverage details, limitations, and exclusions. Pay attention to waiting periods, which are periods of time before certain procedures are covered. For example, some plans may have a waiting period of six months for basic procedures and 12 months for major procedures. Understanding these details will help you avoid unexpected out-of-pocket costs.

Costs of Mutual of Omaha Dental Insurance

The cost of Mutual of Omaha dental insurance varies depending on several factors, including your age, location, the plan you choose, and the coverage level. Premiums can range from a few dollars to over a hundred dollars per month. In addition to premiums, you’ll also need to consider deductibles, coinsurance, and copays.

To get an accurate estimate of the cost of Mutual of Omaha dental insurance, it’s best to get a quote directly from their website or through a licensed insurance agent. Be sure to compare different plans and coverage levels to find the best value for your needs. Consider your expected dental care needs when choosing a plan. If you anticipate needing major dental work, a plan with higher coverage for major procedures may be worth the higher premium.

Customer Satisfaction and Reviews

Customer satisfaction is an important factor to consider when choosing a dental insurance provider. While individual experiences can vary, it’s helpful to research online reviews and ratings to get a sense of the overall customer experience with Mutual of Omaha dental insurance. Look for reviews that mention claims processing, customer service, and the ease of finding in-network dentists.

Mutual of Omaha typically receives mixed reviews. Some customers praise their customer service and the ease of filing claims, while others report difficulties with coverage limitations or claim denials. It’s important to read reviews with a critical eye and consider that experiences can vary. You can check websites like the Better Business Bureau (BBB) and Consumer Affairs for reviews and ratings.

Pros and Cons of Mutual of Omaha Dental Insurance

To help you weigh the pros and cons of Mutual of Omaha dental insurance, here’s a summary of the key advantages and disadvantages:

Pros:

- Reputable Company: Mutual of Omaha is a well-established and reputable insurance company with a long history.

- Wide Range of Plans: Offers a variety of dental insurance plans to suit different needs and budgets.

- Preventive Care Coverage: Most plans cover 100% of preventive care when you see an in-network dentist.

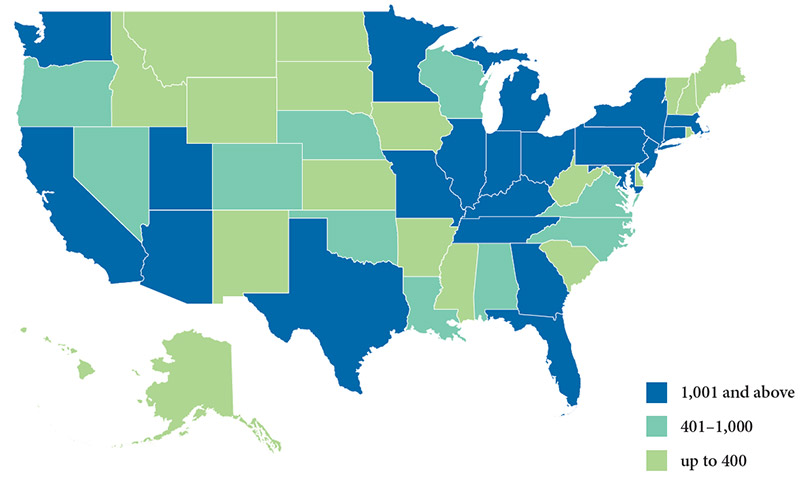

- Network of Dentists: Has a large network of participating dentists, making it easier to find a dentist near you.

Cons:

- Waiting Periods: May have waiting periods for certain procedures, such as basic and major dental work.

- Coverage Limitations: Some plans may have limitations on the types of procedures covered or the frequency of coverage.

- Mixed Customer Reviews: Customer reviews are mixed, with some customers reporting difficulties with claims processing or coverage limitations.

- Annual Maximums: Like most dental insurance plans, Mutual of Omaha plans have annual maximums, which may limit the amount of coverage you receive in a year.

Alternatives to Mutual of Omaha Dental Insurance

If you’re not sure if Mutual of Omaha dental insurance is the right fit for you, there are several alternatives to consider:

- Other Dental Insurance Providers: Explore dental insurance plans from other reputable providers, such as Delta Dental, Cigna, and Aetna. Compare coverage, costs, and customer reviews to find the best option for you.

- Dental Savings Plans: Dental savings plans are not insurance, but they offer discounts on dental services at participating dentists. These plans can be a good option if you don’t need comprehensive coverage or if you have pre-existing conditions that are not covered by insurance.

- Direct Payment to Dentists: Some dentists offer in-house financing or payment plans, which can help you spread out the cost of dental care over time.

- Community Dental Clinics: Community dental clinics offer low-cost dental care to individuals and families with limited incomes.

Making the Right Choice for Your Dental Health

Choosing the right dental insurance plan is a personal decision that depends on your individual needs, budget, and preferences. Mutual of Omaha dental insurance offers a range of plans and coverage options, but it’s important to carefully research and compare different providers before making a decision. Consider your expected dental care needs, read customer reviews, and pay attention to coverage details, limitations, and exclusions.

By taking the time to do your research, you can find a dental insurance plan that helps you maintain your oral health and manage dental care costs effectively. Remember to get quotes from multiple providers and compare their offerings side-by-side. Consider [See also: Understanding Dental Insurance Waiting Periods] and [See also: How to Find Affordable Dental Care]. Ultimately, the best dental insurance plan is the one that meets your specific needs and provides you with peace of mind.

Mutual of Omaha dental insurance can be a viable option for many, but thorough research and comparison are key to making an informed decision. By understanding the details of their plans, coverage options, costs, and customer satisfaction, you can determine if it’s the right choice for you and your family.