Navigating the Workers’ Comp Fee Schedule in New York: A Comprehensive Guide

Understanding the workers’ comp fee schedule New York is crucial for both employers and employees involved in workers’ compensation claims. This schedule dictates the maximum allowable reimbursement rates for medical services provided to employees injured on the job. In New York, the system is designed to ensure fair compensation for healthcare providers while managing costs for employers and insurance carriers. This comprehensive guide will delve into the intricacies of the workers’ comp fee schedule New York, providing clarity on its structure, updates, and implications.

What is the Workers’ Compensation Fee Schedule?

The workers’ comp fee schedule New York is a comprehensive list of medical procedures and services, each assigned a specific code and corresponding reimbursement rate. This schedule applies to all healthcare providers treating workers’ compensation patients within the state. The purpose is to standardize payments, prevent overcharging, and maintain cost control within the workers’ compensation system. Without a structured fee schedule, medical costs could escalate, potentially burdening employers and hindering the system’s overall efficiency.

Essentially, the workers’ comp fee schedule New York acts as a price ceiling. Providers cannot bill above the amounts listed in the schedule for services rendered to injured workers. This fosters transparency and predictability in medical billing for workers’ compensation cases.

Key Components of the New York Workers’ Comp Fee Schedule

The workers’ comp fee schedule New York is complex and multifaceted, encompassing various aspects of medical care. Understanding these components is essential for navigating the system effectively:

- CPT Codes: The Current Procedural Terminology (CPT) codes are used to identify specific medical procedures and services. Each code corresponds to a particular treatment or diagnostic test.

- Reimbursement Rates: Each CPT code is associated with a specific reimbursement rate, which represents the maximum amount a healthcare provider can charge for that service.

- Geographic Adjustments: Reimbursement rates may be adjusted based on geographic location within New York State to account for variations in the cost of living and practice expenses.

- Updates and Revisions: The workers’ comp fee schedule New York is periodically updated to reflect changes in medical practices, technology, and economic conditions. It’s vital to stay informed about these updates to ensure accurate billing and compliance.

Where to Find the New York Workers’ Comp Fee Schedule

The official workers’ comp fee schedule New York is maintained and published by the New York State Workers’ Compensation Board (WCB). The WCB website is the primary source for accessing the most up-to-date information. You can typically find the fee schedule documents and related resources in the “Medical” or “Providers” section of the website. It’s crucial to rely on the official WCB documents to ensure accuracy and compliance.

Additionally, many third-party vendors and software providers offer tools and resources to help navigate the workers’ comp fee schedule New York. These tools often include search functionalities, cross-referencing capabilities, and automated updates, which can streamline the billing and reimbursement process.

Impact of the Fee Schedule on Healthcare Providers

The workers’ comp fee schedule New York directly impacts healthcare providers who treat injured workers. Understanding the fee schedule is essential for accurate billing and reimbursement. Providers must ensure that their billing practices align with the rates and guidelines outlined in the schedule to avoid claim denials or payment delays.

Furthermore, providers need to stay informed about updates and revisions to the workers’ comp fee schedule New York. Changes in CPT codes, reimbursement rates, or billing procedures can significantly affect their revenue cycle. Participating in continuing education and training programs can help providers stay current with the latest developments.

Impact of the Fee Schedule on Employers

Employers also have a vested interest in the workers’ comp fee schedule New York. By understanding the fee schedule, employers can better manage their workers’ compensation costs. Knowledge of the reimbursement rates for medical services allows employers to estimate potential expenses and budget accordingly.

Moreover, the workers’ comp fee schedule New York helps employers ensure that injured employees receive appropriate medical care at reasonable costs. By working with healthcare providers who adhere to the fee schedule, employers can maintain cost control and promote efficient claims management. [See also: Workers’ Compensation Insurance Cost Factors]

Navigating Common Challenges with the Fee Schedule

Despite its intended benefits, navigating the workers’ comp fee schedule New York can present several challenges:

- Complexity: The fee schedule is extensive and complex, with numerous CPT codes and reimbursement rates. Understanding the nuances of the schedule requires careful attention to detail.

- Updates and Revisions: The fee schedule is subject to periodic updates and revisions, which can be challenging to track and implement.

- Coding Errors: Incorrect coding can lead to claim denials or payment delays. Healthcare providers must ensure that their coding practices are accurate and compliant.

- Disputes: Disputes may arise between healthcare providers and insurance carriers regarding reimbursement rates or the appropriateness of medical services.

To overcome these challenges, it’s essential to seek expert guidance and utilize available resources. Consulting with workers’ compensation specialists, attending training programs, and using specialized software can help streamline the process and minimize errors.

Tips for Accurate Billing and Reimbursement

Accurate billing and reimbursement are crucial for both healthcare providers and employers involved in workers’ compensation claims. Here are some tips to ensure a smooth and efficient process:

- Verify Eligibility: Before providing medical services, verify the employee’s eligibility for workers’ compensation benefits.

- Use Correct CPT Codes: Ensure that you are using the correct CPT codes for the services rendered.

- Document Thoroughly: Maintain detailed documentation of all medical services provided, including dates, descriptions, and CPT codes.

- Submit Claims Promptly: Submit claims promptly to avoid delays in reimbursement.

- Stay Informed: Stay informed about updates and revisions to the workers’ comp fee schedule New York.

- Seek Expert Guidance: Don’t hesitate to seek expert guidance from workers’ compensation specialists or billing professionals.

Recent Updates to the Workers’ Comp Fee Schedule New York

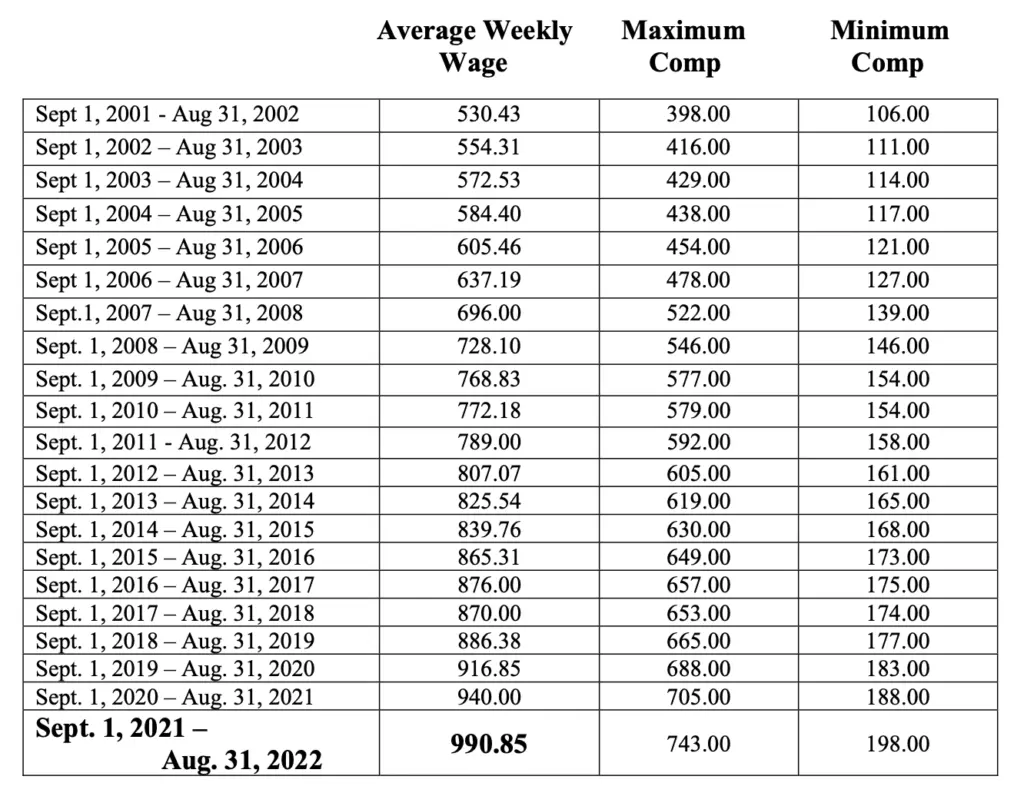

Staying informed about recent updates to the workers’ comp fee schedule New York is crucial for compliance and accurate billing. The New York State Workers’ Compensation Board (WCB) regularly updates the fee schedule to reflect changes in medical practices, technology, and economic conditions.

Recent updates may include revisions to CPT codes, adjustments to reimbursement rates, and changes to billing procedures. It’s essential to review the official WCB website and publications to stay abreast of these changes. Failure to comply with the latest updates can result in claim denials or penalties.

For example, in recent years, there have been updates to the fee schedule related to telemedicine services and the utilization of new medical technologies. These updates aim to promote access to care and improve the efficiency of the workers’ compensation system. [See also: Understanding Workers’ Compensation Benefits]

The Future of Workers’ Compensation Fee Schedules

The workers’ comp fee schedule New York, like all fee schedules, is subject to ongoing evaluation and refinement. As healthcare evolves and technology advances, the fee schedule must adapt to reflect these changes. Future developments may include:

- Increased Transparency: Efforts to enhance transparency and accessibility of the fee schedule.

- Value-Based Care: Integration of value-based care principles to reward providers for delivering high-quality, cost-effective care.

- Data Analytics: Use of data analytics to identify trends, monitor costs, and improve outcomes.

- Stakeholder Collaboration: Enhanced collaboration among stakeholders, including healthcare providers, employers, and insurance carriers, to ensure that the fee schedule meets the needs of all parties involved.

Conclusion

The workers’ comp fee schedule New York is a critical component of the state’s workers’ compensation system. Understanding the fee schedule is essential for healthcare providers, employers, and employees alike. By staying informed about the fee schedule, following best practices for billing and reimbursement, and seeking expert guidance when needed, stakeholders can navigate the system effectively and ensure that injured workers receive appropriate medical care at reasonable costs. The workers’ comp fee schedule New York is a dynamic document, and continuous learning and adaptation are key to success in this ever-evolving landscape. The efficient management of workers’ comp fee schedule New York ensures fair compensation and contributes to a healthy and productive workforce. The continued monitoring and understanding of the workers’ comp fee schedule New York is vital for all involved parties to ensure compliance and optimal outcomes. Keeping abreast of the updates to the workers’ comp fee schedule New York allows for proactive management of costs and resources. Effective navigation of the workers’ comp fee schedule New York leads to better healthcare outcomes for injured workers. Knowledge of the workers’ comp fee schedule New York empowers employers to manage their responsibilities effectively. Staying updated on the workers’ comp fee schedule New York is essential for maintaining a compliant and efficient workers’ compensation program.