Decoding the CPT Code for ECG in Office: A Comprehensive Guide

Understanding the Current Procedural Terminology (CPT) codes is crucial for healthcare providers, especially when it comes to billing and reimbursement for services rendered. One common procedure performed in many offices is the electrocardiogram (ECG or EKG). This article provides a comprehensive guide to the CPT code for ECG in office settings, ensuring accurate coding and billing practices. We’ll delve into the specifics of different ECG CPT codes, common billing errors, and best practices for documentation.

What is an Electrocardiogram (ECG)?

An electrocardiogram (ECG) is a non-invasive diagnostic test that records the electrical activity of the heart over a period of time using electrodes placed on the skin. It is used to detect various heart conditions, such as arrhythmias, heart attacks, and other cardiac abnormalities. The procedure is quick, painless, and provides valuable information about a patient’s heart health. Properly understanding the CPT code for ECG in office is essential for accurate claim submission and reimbursement.

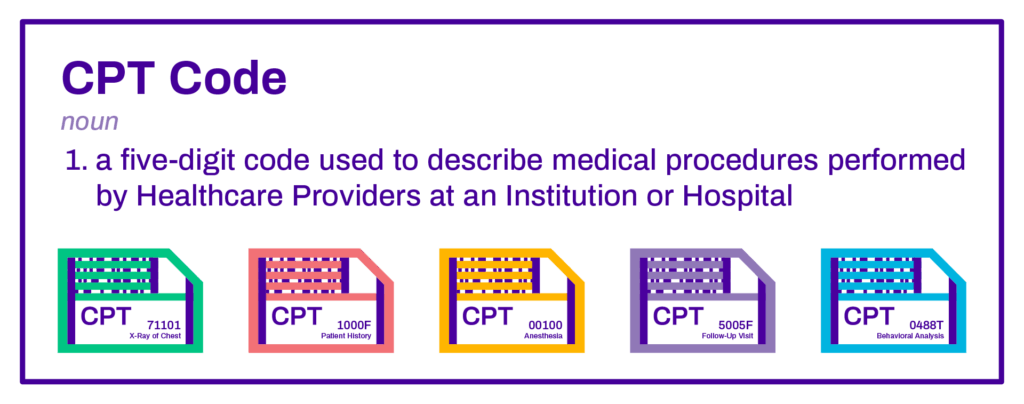

Understanding CPT Codes

CPT codes are a standardized set of codes used to report medical, surgical, and diagnostic procedures and services to payers for reimbursement. These codes are maintained by the American Medical Association (AMA) and are updated annually. Accurate use of CPT codes ensures that healthcare providers are appropriately compensated for their services. Failing to use the correct CPT code for ECG in office can lead to claim denials or underpayments.

Specific CPT Codes for ECG in Office

Several CPT codes are relevant to ECG procedures performed in an office setting. The specific code used depends on the complexity and type of ECG performed. Here are some of the most common ECG CPT codes:

93000 – Electrocardiogram, routine ECG with at least 12 leads; with interpretation and report

This code is used for a standard 12-lead ECG that includes the tracing, interpretation, and a written report. It’s the most common CPT code for ECG in office when a full interpretation and report are provided by the physician. Remember, the interpretation and report are key components. Without them, this code might not be appropriate.

93005 – Electrocardiogram, routine ECG with at least 12 leads; tracing only, without interpretation and report

This code is used when only the ECG tracing is performed, and the interpretation and report are done elsewhere (e.g., by a cardiologist at a different facility). This is less frequently used in an office setting where the physician typically provides the interpretation. If your office is only providing the tracing, make sure to use this ECG CPT code.

93010 – Electrocardiogram, routine ECG with at least 12 leads; interpretation and report only

This code is used when a physician interprets and reports on an ECG tracing that was performed elsewhere. This is also less common in a typical office setting unless the physician is specifically contracted to provide interpretation services for ECGs performed at other locations. Using this CPT code for ECG in office requires careful documentation of where the tracing originated.

93040 – Rhythm ECG, one to three leads; with interpretation and report

This code is used for a rhythm ECG, which involves monitoring the heart’s rhythm using one to three leads. It includes the interpretation and report. This might be used for brief monitoring of a patient’s heart rhythm in the office. The key differentiator from 93000 is the number of leads used. When using this ECG CPT code, ensure the documentation clearly states the number of leads.

93041 – Rhythm ECG, one to three leads; tracing only, without interpretation and report

Similar to 93005, this code is used when only the tracing is performed for a rhythm ECG, and the interpretation is done elsewhere. If your office is only providing the tracing for a rhythm ECG, this is the appropriate ECG CPT code.

93042 – Rhythm ECG, one to three leads; interpretation and report only

This code is used when a physician interprets and reports on a rhythm ECG tracing that was performed elsewhere. This is also less common in a typical office setting unless the physician is specifically contracted to provide interpretation services for rhythm ECGs performed at other locations. Using this CPT code for ECG in office requires meticulous record-keeping.

Common Billing Errors and How to Avoid Them

Several common billing errors can occur when coding for ECGs. Understanding these errors and implementing preventive measures can help ensure accurate billing and avoid claim denials.

- Incorrect Code Selection: Choosing the wrong CPT code for ECG in office is a frequent error. Always verify the specific details of the service provided to ensure the correct code is used. For example, using 93000 when only a tracing was performed.

- Lack of Documentation: Insufficient documentation to support the services billed is a major cause of claim denials. Ensure that the medical record clearly documents the ECG tracing, interpretation, and report.

- Bundling Errors: Some payers may bundle certain services together, meaning they are included in the payment for another service. Be aware of bundling rules and avoid billing separately for services that are considered part of a larger procedure.

- Modifier Misuse: Modifiers are used to provide additional information about a service, such as indicating that it was performed with a specific circumstance. Using modifiers incorrectly can lead to claim denials.

Best Practices for ECG Coding and Billing

To ensure accurate coding and billing for ECGs, follow these best practices:

- Stay Updated: CPT codes are updated annually. Stay informed about the latest changes and updates to ensure accurate coding.

- Proper Documentation: Maintain thorough and accurate documentation of all ECG procedures, including the tracing, interpretation, and report.

- Verify Payer Requirements: Different payers may have specific requirements for ECG coding and billing. Verify these requirements before submitting claims.

- Educate Staff: Provide ongoing training and education to staff involved in coding and billing to ensure they are knowledgeable about ECG coding guidelines.

- Regular Audits: Conduct regular internal audits to identify and correct any coding errors or billing discrepancies.

The Importance of Accurate Documentation

Accurate and comprehensive documentation is the cornerstone of proper coding and billing. For ECGs, documentation should include:

- Date and time of the procedure

- Patient’s name and medical record number

- Reason for the ECG

- Number of leads used

- A clear and concise interpretation of the ECG findings

- A written report summarizing the results and any recommendations

- The name and credentials of the interpreting physician

Without proper documentation, it becomes difficult to justify the CPT code for ECG in office used, potentially leading to claim denials and compliance issues.

Impact of Technology on ECG Coding

Advancements in technology have led to more sophisticated ECG equipment and techniques. These advancements can impact coding practices. For example, some ECG machines offer automated interpretation features. However, it is crucial for a qualified physician to review and validate the automated interpretation to ensure accuracy. The physician’s review and report are necessary for using the 93000 ECG CPT code.

Staying Compliant with Regulations

Healthcare providers must adhere to various regulations related to coding and billing, including HIPAA (Health Insurance Portability and Accountability Act) and other federal and state laws. Compliance with these regulations is essential to avoid penalties and legal issues. When dealing with the CPT code for ECG in office, ensure all processes align with current compliance standards.

Conclusion

Accurate coding and billing for ECGs are essential for healthcare providers to receive appropriate reimbursement for their services. By understanding the specific CPT code for ECG in office settings, avoiding common billing errors, and following best practices for documentation, providers can ensure accurate claims submission and compliance with regulations. Keeping up-to-date with changes in CPT codes and payer requirements is also crucial for maintaining accurate and efficient billing processes. Mastering the nuances of ECG CPT codes ultimately benefits both the provider and the patient by ensuring fair compensation and quality care. Regular training and audits can further enhance the accuracy of ECG coding and billing practices within the office. [See also: Cardiology Billing Best Practices] [See also: Common Medical Coding Errors] [See also: Understanding E/M Coding Guidelines]